219 private links

Oracle’s astonishing $300bn OpenAI deal is now valued at minus $60bn

AI’s circular economy may have a reverse Midas at the centre

Les pertes abyssales d'OpenAI

Plus de 12,5 milliards de dollars en seulement trois mois

For much of the AI boom, there have been whispers about Nvidia’s frenzied dealmaking. The chipmaker bolstered the market by pumping money into dozens of AI startups, many of which rely on Nvidia’s graphics processing units to develop and run their models. OpenAI, to a lesser degree, also invested in startups, some of which built services on top of its AI models. But as tech firms have entered a more costly phase of AI development, the scale of the deals involving these two companies has grown substantially, making it harder to ignore.

Current growth is also “not coming from AI itself but from building the factories to generate AI capacity,” he added, suggesting that the tech industry is selling a still-hypothetical future rather than delivering a real one.

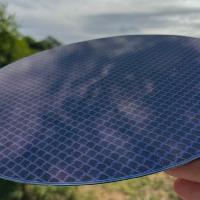

It’s true that investment in AI has reached a fever pitch lately. Earlier this week, AI chipmaker Nvidia announced that it’s pouring $100 billion into OpenAI as part of a “strategic partnership” to “build and deploy at least ten gigawatts of AI datacenters” — a deal that critics immediately slammed as self-serving.

“It may not be an exaggeration to write that NVIDIA — the key supplier of capital goods for the AI investment cycle — is currently carrying the weight of US economic growth,” Saravelos argued.

“The bad news is that in order for the tech cycle to continue contributing to GDP growth, capital investment needs to remain parabolic,” he concluded. “This is highly unlikely.”

Now that all the pieces are in place, here is the economic nexus of semi/genAI that particularly interests me:

If model providers make inference much more efficient, then they will not use enough computing power to consume all that is brought to market by the semiconductor industry. If this happens, it will trigger a downward cycle in this industry, significantly slowing down the production of new hardware and possibly having significant global economic and financial repercussions.

If model providers do not make their inference processes more efficient, they will not be able to structurally reduce their marginal costs and, failing to achieve the desired profitability, will resort to the usual means (advertising, tiered subscriptions), which will slow down adoption.

If adoption slows down, model providers will struggle to achieve profitability (with the exception of those with captive markets), their demand for computing power will weaken, and the semiconductor industry will produce excess capacity and enter a downward cycle, taking part of the AI industry with it.So, the central issue linking today’s semiconductor industry and genAI model providers is how to define how much efficiency gains are enough. Jokingly, we could call this ‘inference inefficiency optimum’.

At some point the momentum behind NVIDIA slows. Maybe it won't even be sales slowing — maybe it'll just be the suggestion that one of its largest customers won't be buying as many GPUs. Perception matters just as much as actual numbers, and sometimes more, and a shift in sentiment could start a chain of events that knocks down the entire house of cards.

I don't know when, I don't know how, but I really, really don't know how I'm wrong.

I hate that so many people will see their retirements wrecked, and that so many people intentionally or accidentally helped steer the economy in this reckless, needless and wasteful direction, all because big tech didn’t have a new way to show quarterly growth. I hate that so many people have lost their jobs because companies are spending the equivalent of the entire GDP of some European countries on data centers and GPUs that won’t actually deliver any value.

But my purpose here is to explain to you, no matter your background or interests or creed or whatever way you found my work, why it happened. As you watch this collapse, I want you to tell your friends about why — the people responsible and the decisions they made — and make sure it’s clear that there are people responsible.

Sam Altman, Dario Amodei, Satya Nadella, Sundar Pichai, Tim Cook, Elon Musk, Mark Zuckerberg and Andy Jassy have overseen a needless, wasteful and destructive economic force that will harm our economy and the tech industry writ large, and when this is over, they must be held accountable.

And remember that you, as a regular person, can understand all of this. These people want you to believe this is black magic, that you are wrong to worry about the billions wasted or question the usefulness of these tools. You are smarter than they reckon and stronger than they know, and a better future is one where you recognize this, and realize that power and money doesn’t make a man righteous, right, or smart.